difference between islamic banking and conventional banking in malaysia

This paper aims to assess the nature of competition between conventional and Islamic banks operating in Malaysia. Raising capital is equally important to both the conventional market and the Islamic Capital Market except that there is a major difference in.

Islamic Banking Services In Malaysia With Its Concept Of Shariah Download Table

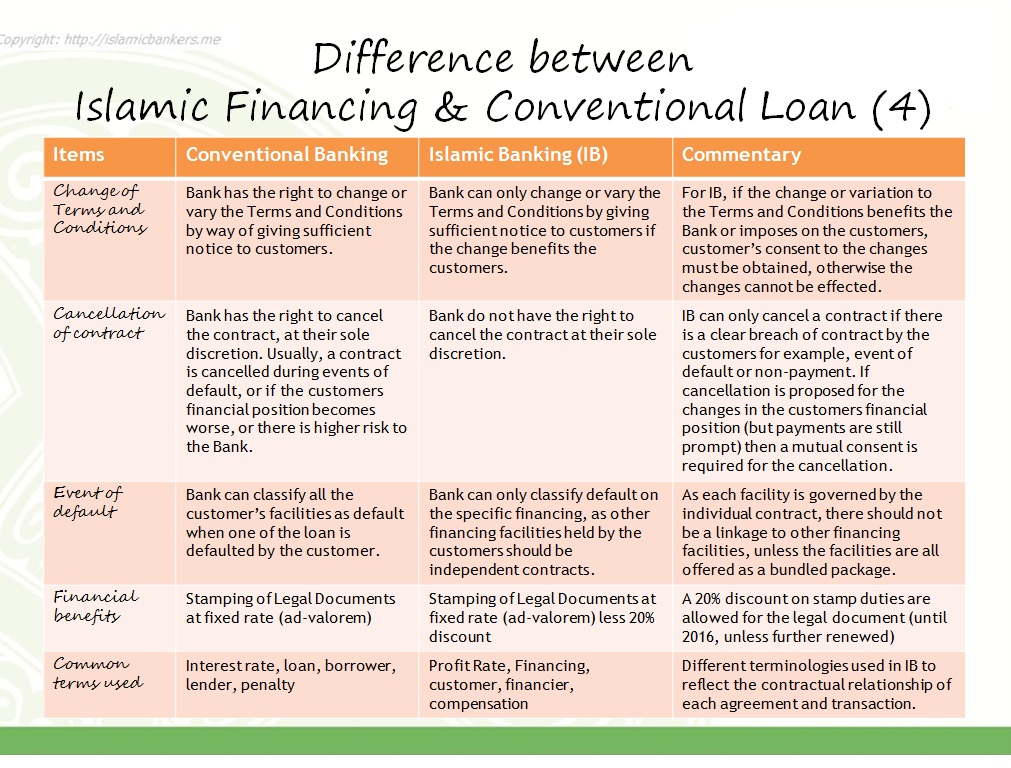

For Conventional loans if a borrower alters the terms of the finance Eg.

. Evidence from Malaysia International Journal of Islamic Banking Finance Vol. Profit on exchange of goods services is the basis for earning. Any Islamic finance loan restructuring requires a whole new contract agreement to be created and signed.

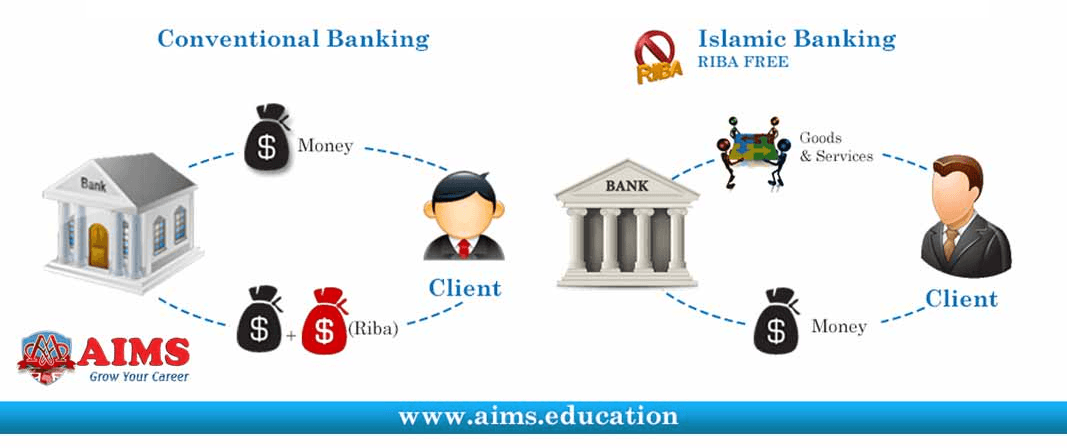

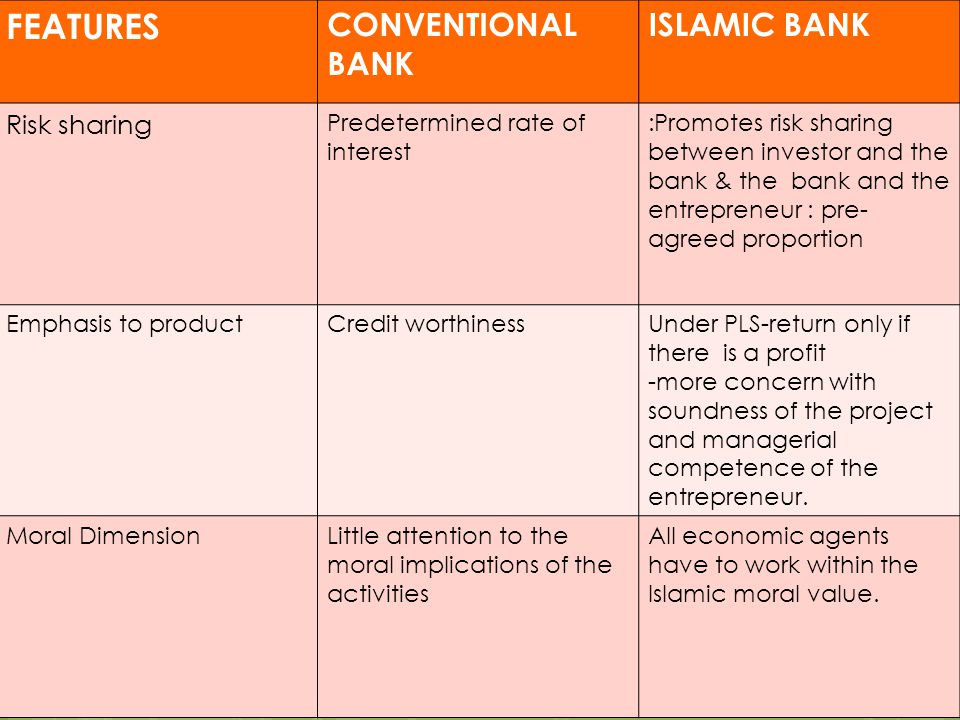

Both systems accept deposits from consumers and commercial entities and offer various financing solutions to them. Money is a product besides medium of exchange and store of value. Thus all dealing transactions business approach product feature investment focus responsibility are derived from the Shariah law which lead to the significant difference in many part of the operations the conventional banking.

Increase the facility amount the Loan Facility Agreement would only need to be up-stamped. Real Asset is a product. There are more legal documents involved for Islamic banking in Malaysia so your legal fees may be significantly higher.

However specific considerations have been taken to separate the two and ensure. These are the limitations of Islamic banking in Malaysia. Difference Between Islamic Banking and Conventional.

Ability of the Islamic banking in Malaysia to be an alternative or substitute for the commercial bank during the financial crisis. On the other hand Conventional Banking is an Un-Ethical Banking system based on Man-Made Laws. A sample of 545 banks 250 Islamic banks.

Money is just a medium of exchange. Unlike Conventional Banks an Islamic Bank acts as an intermediary between the depositor and the entrepreneur. Bank Islam Malaysia Berhad BIMB was the first Islamic bank in Malaysia having been set up on 1 July 1983.

Time value is the basis for charging interest on capital. Islamic banking products are usually asset backed and involves trading of assets renting of asset and participation on profit loss basis. In addition this paper also examine the stability of Islamic bank compared to commercial banks that in which at the end focusing on the target towards the achievement of sustaining in the real economic growth and.

In Islamic Banking on the other hand bank depositors receive their returns depending solely on the banks performance. The main difference is that Islamic Banking is based on Shariah foundation. At first glance it may seem as though there is little to differentiate between Islamic and conventional banking.

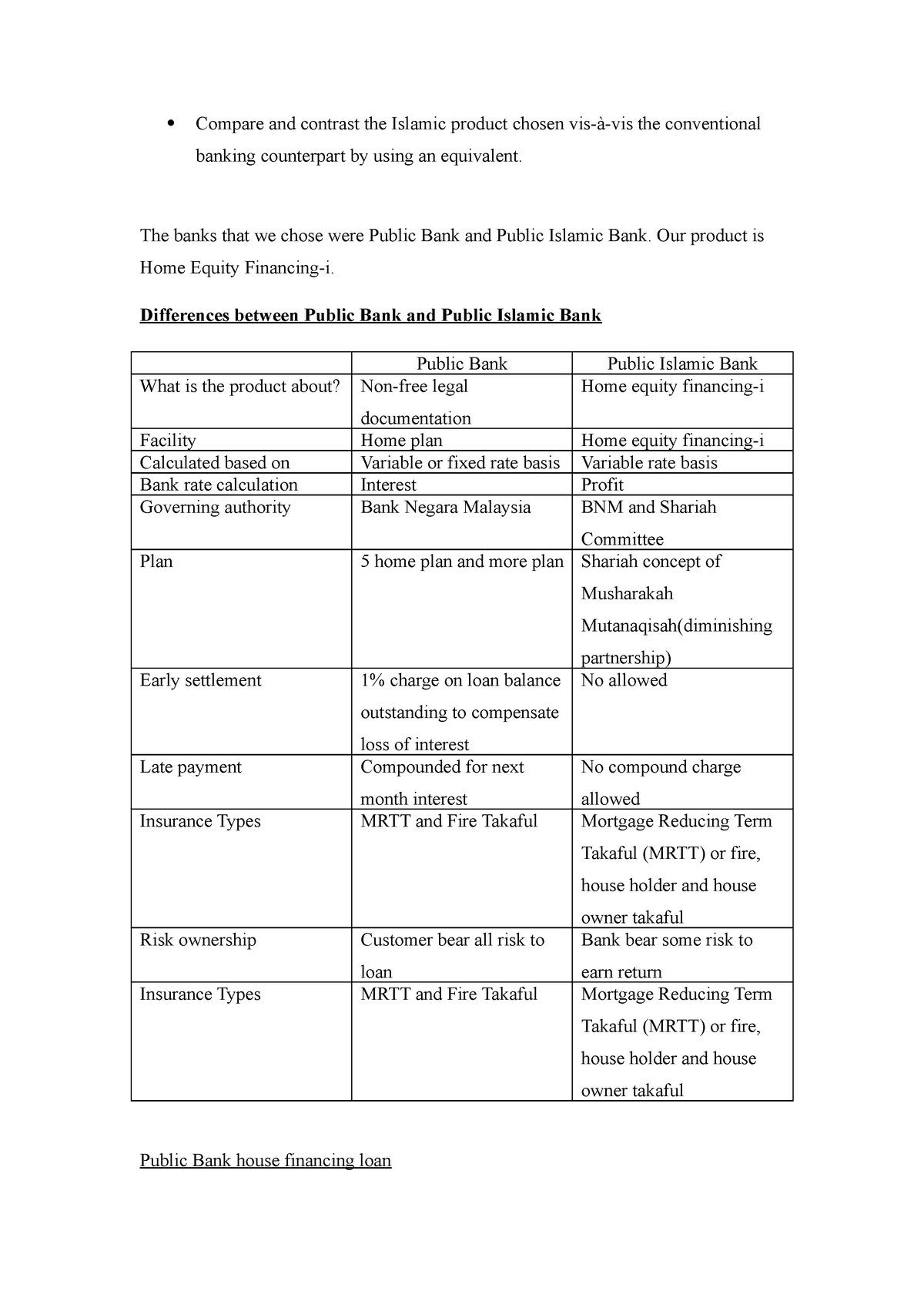

Now let us review some major differences between Islamic banking and conventional banking systems. This assignment briefly explains the differences between Islamic banking and conventional banking. 8 Aug 2018 - Wed 1 day 300pm - 500pm Selangor Bar Committee Auditorium No37 39 41 Jalan Bola Jaring 1315 Section 13 Shah Alam 40100 Selangor.

The performance of banking during 2000-2009. Based on the Malaysian Islamic Banking Act 1983 Islamic banking is a comprehensive and value-based system that aims to respect and enhance the moral and material wellbeing of individuals and society in general Yahya et al 2012. Islamic banking institutions are governed by Sharia or Islamic law.

The main distinction between an Islamic and a conventional bank is the structure and principles that govern them. Conventional Bank treats money as a commodity and lend it against interest as its compensation. Textbook Solutions Expert Tutors Earn.

Conventional Banking vs Islamic Banking. For Islamic financing a new Sale And Buy-back Agreement BBA needs to be drawn up making it more expensive. A Comparison of Leverage and Profitability of Islamic and Conventional Bank TOUMI VIVIANI BELKACEM 2011 The researcher through this paper examines the differences between the Islamic and Conventional banking systems with special focus on the leverage and profitability.

The Quran Islams sacred book forbids any transactions from receiving and paying interest known as Riba because interest-bearing credit structures are thought. Benefits of Conventional Financing over Islamic Financing. Relation of customer bank is of Creditor-Debtor.

Real Asset is a product Money is just a medium of exchange. This is more expensive than conventional loans which only. Key Differences between Conventional and Islamic Banking.

Documents similar to Differences between Islamic banking and conventional banking are suggested based on similar topic fingerprints from a variety of other. Tunku Abdul Rahman University College. Major Differences Between Islamic and Conventional Banking.

Money is a product besides medium of exchange and store of value. This talk will discuss introduction to conventional banking introduction to Islamic banking mechanics of conventional and Islamic banking. March 2014 Comparison between Islamic and Conventional Banking.

In Conventional Banks almost all the financing and deposit side products are loan based. ABMF3213 - Islamic Banking. Bank islam malaysia berhad and conventional banking in malaysia By Shaza Marina Azmi Medical Takaful Insurance Reform Model and Structure JIBF Pp 22-38pdf.

As such Islamic banks declare their profits on a monthly basis as part of their risk sharing scheme. View Difference Between Islamic Banking and Conventional Banking personal findocx from COB BWFF3033 at Northern University of Malaysia. Difference from Conventional Banking.

Loans to deposits and common equity to total assets have a correlation moderately high negative of -0672 while cash deposits and. It is an effort to enrich the existing literature by offering an empirical compromise on the differences in the results of studies related to competition between the two types of banksSecondary data on all banks operating in Malaysias diversified. Relationship of customer bank is of Seller- Buyer and.

Some Viewpoints Of Islamic Banking Retail Deposit Products In Malaysia Open Access Journals

Islamic Banking Vs Conventional Banking Aims Uk

Pdf Comparison Between Islamic And Conventional Banking Evidence From Malaysia

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

Banks Islamic Bankers Resource Centre

Financial Inclusion Of Malaysians Through Digital Financial Bank Dfb My Money And Me Financial Literacy Community

Pdf Issues Of Implementing Islamic Hire Purchase In Dual Banking Systems Malaysia S Experience Semantic Scholar

Conventional Banking Islamic Bankers Resource Centre

A Comparison Between Malaysia And Indonesia In Islamic Banking Industry Semantic Scholar

Conventional Banking Islamic Bankers Resource Centre

Pdf An Empirical Investigation Into The Problems And Challenges Facing Islamic Banking In Malaysia Semantic Scholar

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Differences Of Components In Balance Sheet Of Islamic And Conventional Download Table

Conventional Banking Islamic Bankers Resource Centre

Comparison Ib Compare And Contrast The Islamic Product Chosen Vis A Vis The Conventional Banking Studocu

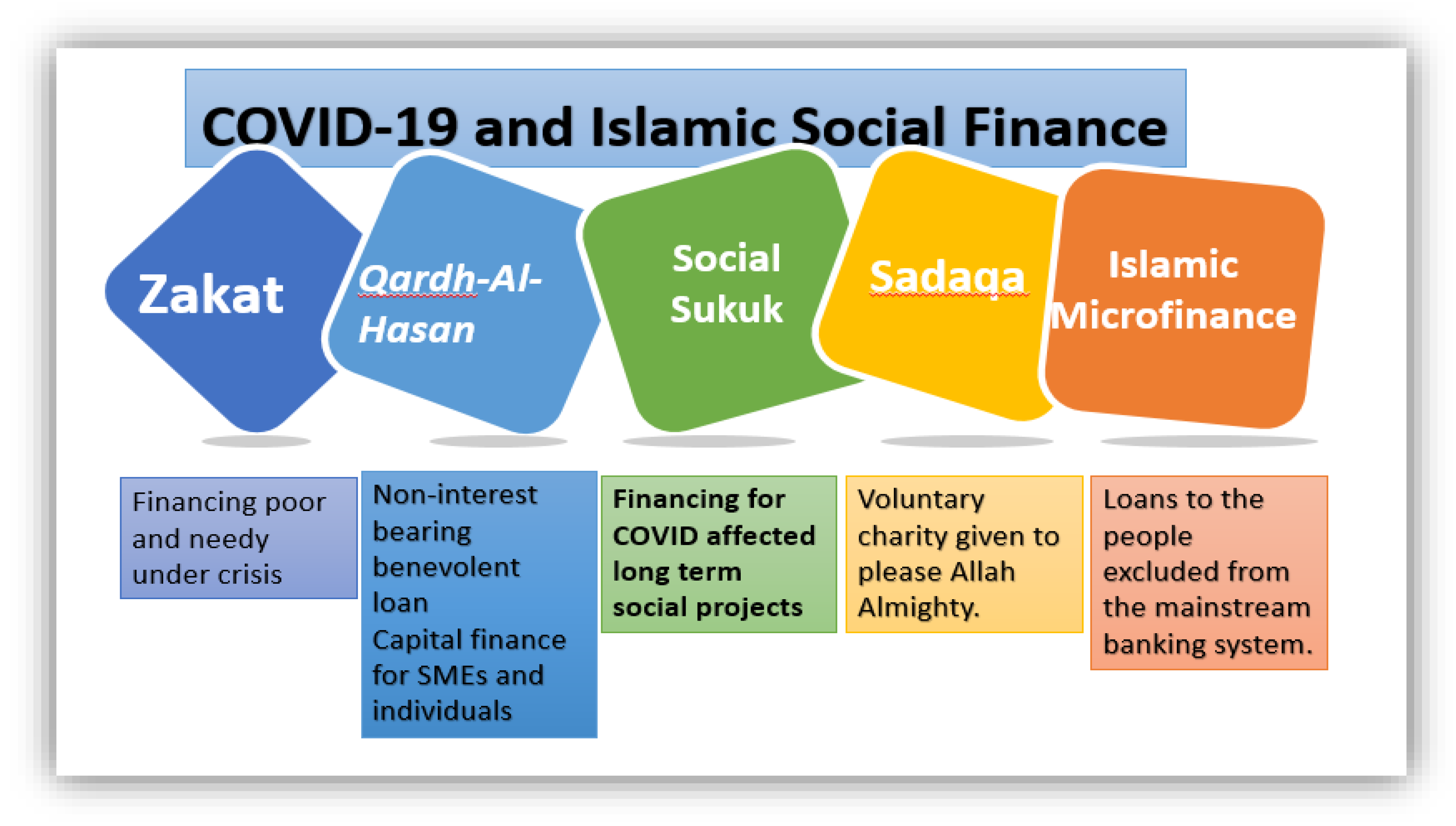

Joitmc Free Full Text Exploring The Role Of Islamic Fintech In Combating The Aftershocks Of Covid 19 The Open Social Innovation Of The Islamic Financial System Html

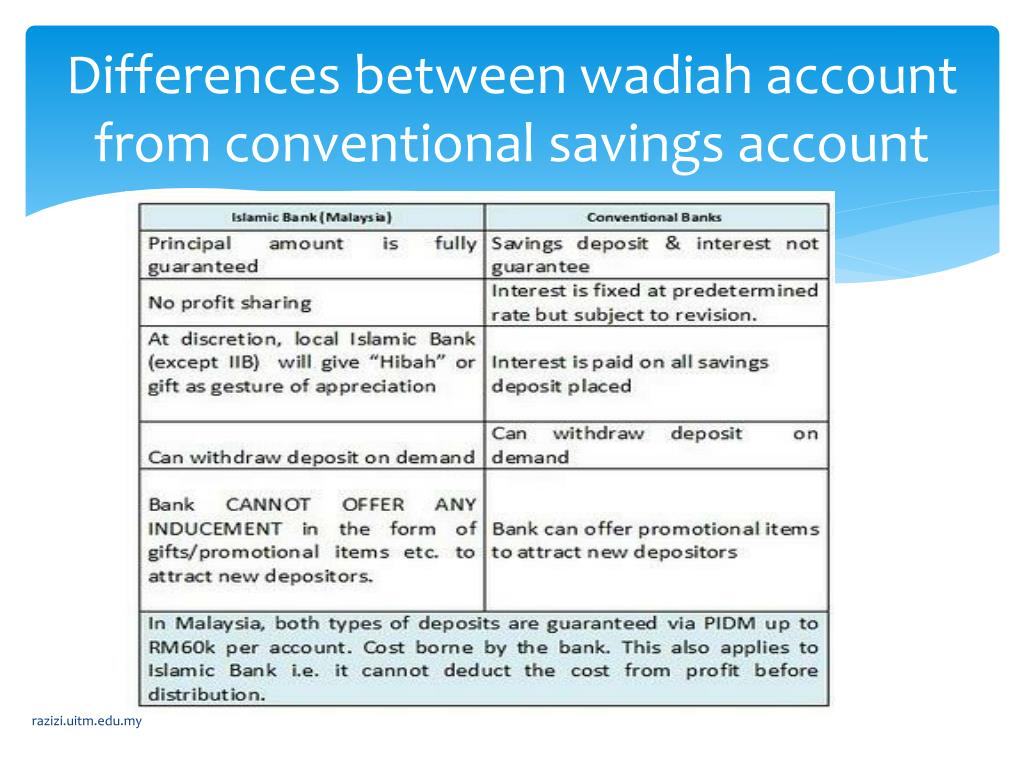

Ppt Islamic Banking Isb 300 Powerpoint Presentation Free Download Id 1672197

No comments for "difference between islamic banking and conventional banking in malaysia"

Post a Comment